Industry Trends

Marketing Insights

This month, Home Channel News published our article on future demand in the home remodeling industry. The following is a transcript of the article:

The residential remodeling and replacement market kept many companies in the home and building industry in business during the past few years. Now, even as new home builds rebound in many markets, the evidence suggests the remodeling market will continue to flourish.

Our research partner, The Farnsworth Group, collaborated with The Joint Center for Housing Studies at Harvard University to investigate the dynamics driving the remodeling market. They forecasted future activity trends while considering key factors, including the current housing stock, changing demographics, the economics and emotions of demand, and the current market structure and forecast.

Leading indicators for growth in the remodeling market are almost universally accelerating, and a decided increase in that pace is predicted for the third quarter of this year. Brad Farnsworth, whose company investigates remodeling market drivers, is confident the growth will continue into the foreseeable future. In fact, double-digit growth is expected to continue for the entire year, and some economists project double-digit growth beyond this year.

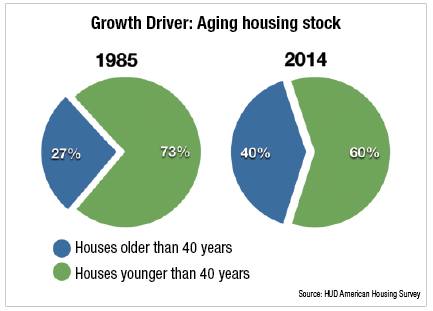

Some of this growth will be discretionary, which is not too surprising considering research the past few years has revealed considerable pent-up consumer demand. Much of the future activity may not be by choice, though, as the existing housing stock has aged considerably in recent years. The Department of Housing and Urban Development’s “American Housing Survey” indicates that only 27% of homes were at least 40 years old in 1985; but now, more than 40% of homes are at least 40 years old.

For marketers, it may make sense to focus on the markets in which older housing stocks exist. In fact, various studies suggest that 80% of forecasted residential remodeling and replacement activity is expected to occur in about 20% of the U.S. markets. In addition, about half of all remodeling and replacement activity is driven by just more than 20% of the households in the U.S. These households spend a higher share on discretionary updates, and in markets where the housing stock is older, nondiscretionary activity is also high.

Who are these households? About two in every five replacement and remodeling projects in the U.S. are completed by households aged 55-plus. These homeowners spend for several reasons, including retrofitting to accommodate their changing needs, making alterations to improve things like energy efficiency and costs, improvements to gain more enjoyment from their home, and making required repairs to aging homes. Meanwhile, millennials are adding additional, sustainable momentum. Recent research reveals that millennials, a group 7% percent larger than baby boomers, often prefer to purchase older homes. In fact, the average age of homes purchased by millennials last year was 27 years.

Some of the factors impacting millennial purchases of older homes include:

- Student loan debt, which can impact the amount they can borrow; less expensive, older homes often are more viable.

- The choice to live in urban or central cities where there is limited new housing stock.

- Preference for a fixer-upper home (almost a third of millennials prefer fixer-uppers to a house that needed minimal repairs, according to a Better Homes and Gardens Real Estate report).

Much has been written on the differences in marketing to boomers versus millennials. While the desire to own a home may be propelled by many of the same emotional drivers across generations, millennials move through the purchase cycle differently than their predecessors. Millennials are much more likely than other generations to get information from a range of media platforms, including social media. They are also more likely to turn to their peers’ opinions of products and services before other research options.

The future for remodeling looks very bright. Knowing why consumers remodel, where the remodeling will occur and who will make the decisions could make the future even brighter for those serving the industry.